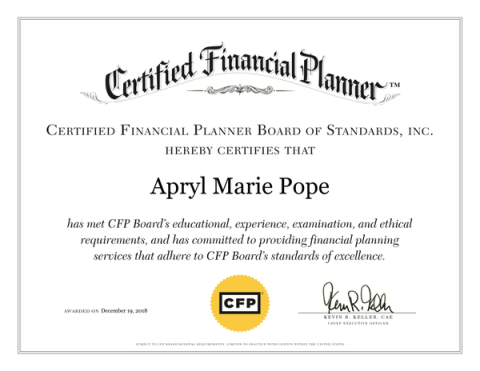

As a financial planning client, you will work one-on-one with a CERTIFIED FINANCIAL PLANNER™ Professional to design a working plan to use your money and resources in striving to create and live the life you desire and deserve.

Helping you live your best life!

STEP 1 - What do I really want in life?

- 45-90 minute discovery and goal definition meeting

STEP 2 - Where is all my stuff?

- 45-90 Financial Organization Meeting

STEP 3 - Where is my money going?

- 30-45 Minute Cash Flow Planning Session

- 30-45 Minute Phone Call - Debt Elimination Planning Session

STEP 4 - What should I do?

- 45-90 Minute Recommendations Meeting with your CFP® Professional

STEP 5 - How can I make sure I stick to my plan?

- 20 Minute Monthly Check-in Meetings

- Email and Phone Support (9:00am-5:00pm M-F)

- Up to 2 hours of Collaboration with other Professionals you work with (i.e. CPAs, attorneys, insurance agents, etc.)

- Recommendations to other financial professionals in our network

Common Financial Planning Topics

CASH FLOW AND SPENDING PLAN

Create a monthly and annual cash flow statement based on current income and expenses

- Organize income and expenses

- Create automated savings plan

- Review/set up auto bill pay for recurring expenses

- Analyze 3 months of transactions history

- Automatic monitoring of spending through eMoney website

- Create savings plan for goals

DEBT DESTRUCTION PLANNING

Create a step-by-step action plan to crush your debt and rescue your monthly income

- Credit report review and analysis

- Form letters to dispute error on credit reports

- Analysis of all current debts

- Detailed debt elimination plan

- Student loan repayment strategy

- Mortgage/Refinance Review

PERSONAL RISK MANAGEMENT PLANNING

Ensure that you and your family are adequately covered and protected against the unforeseen

- Review of current insurance policies (life, disability, auto, home, and umbrella coverages)

- Determine appropriate insurance coverage for you

- Employer benefits package review

- Evaluate need for long-term care insurance

RETIREMENT PLANNING

Create a detailed plan aiming to help ensure that you don’t run out of money in retirement

- Analyze all sources of retirement income

- Create a cash flow plan for retirement

- Create a pre-retirement debt management plan

- Discuss options for healthcare

- Social security benefits review

- Charitable giving strategies

- Pension payment options review

- Explore options for guaranteed income in retirement

EDUCATION PLANNING

Help navigate the process for getting your child enrolled in a school that fits their dreams and your pockets!

- Evaluate 529 College Savings Plan options

- Help navigate the process from application to enrollment

- Financial Aid Package review

- Create a student budget

- Scholarship tracking sheet

- Discuss options for a debt free education

ESTATE PLANNING STRATEGIES *(UP TO 2 HOURS INCLUDED)

Leave a legacy for your loved ones

- General estate planning and gifting strategies

- General trust planning and education

- Discuss impact of beneficiary designations

- Explanation of estate planning structures and documents - wills, POA, Trusts, etc.

What Do I Get as a Financial Planning Client?

-

Clarity and definition of your top financial goals

-

Personalized recommendations to organize your financial life

-

Detailed cash flow plan and suggestions to align your spending patterns with your financial priorities

-

Step-by-step action plan to crush your debt and rescue your monthly income

-

Recommendations to help ensure you and your family are protected against the unforeseen

How do you know if you are a good fit for Financial Planning?

You…

-

Are ready for a change in your financial life

-

Need accountability, guidance and ongoing support to reach your financial goals

-

Are willing to do the work to reach your goals

-

Don’t have the time, knowledge, or energy to manage your finances on your own

-

Want and value a long-term relationship